Understanding How Annual Percentage Rate (APR) is Calculated

Nov 11, 2022

You might have noticed that when you apply for a loan amount, you often have to pay back to the lending institution more than the principal amount. The additional repayment can consist of components like interest, annual percentage rate, closing costs, etc., and differ from one lender to another. Secured and unsecured loans levy APR charges.

This article talks about what "annual percentage rate" means and its formula to calculate for different types of loans.

What Does APR Mean?

The term Annual Percentage Rate (APR) is popular in the area of loans. Be it a personal loan or housing finance, every lending institution charges a certain percentage of fees for the fact that it gave you a loan for your requirements.

The annual percentage rate definition is, in simple terms, the cost that lending bodies charge you for processing fees, insurance charges, administrative costs, etc. APR is typically higher than the regular interest rate on your loan.

How Does APR Work and How To Calculate APR?

Usually, the APR is based on your creditworthiness. The best annual percentage rate ranges from 6% to 36%. This is added to the total sum that you must repay but is not included in the compounding formula considered while calculating the loan interest value.

Apply Now

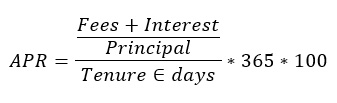

The annual percentage rate formula is:

*Note that the tenure considered must be in the unit of days.

Let us consider an example for you to understand the calculation better.

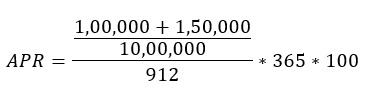

Let us assume that a person applies for a personal loan of a principal amount of INR 10,00,000 for the upcoming festive season expenses. The lending institute fixes the rate of interest at 15% over a tenure of 30 months. This comes down to INR 1,50,000. The tenure in days is approximately 912 days. If the processing fees are 10%, this amounts to INR 1,00,000.

Thus, the APR is calculated as:

Thus, the annual percentage rate here comes out to 10%.

Why Do You Need to Know The Annual Percentage Rate?

It is very important to know the APR beforehand. There are three main reasons for this:

- Different banking institutes charge different amounts of annual percentage rate on the same interest rate, principal amount, etc. Thus, the APR can be a major determinant of which lending institution you choose.

- Since annual percentage rates can be higher than interest rates for the given tenure, it is essential that you be sure to calculate the annual percentage rate before signing up for any loan, so that you are aware of all overhead charges. This can help you manage your budget.

- Higher the loan amount and higher the tenure, higher your APR because of processing fees and administrative charges. Hence, this can heavily affect your financial planning.

What is A Good APR?

From personal loans to home loans, annual percentage rates ranging from 6% to 36% are considered good APRs. Anything above can mean that you will overshoot your expenses. At SMFG Grihashakti, processing fees are as low as 3% to 6%, foreclosure charges are from 3% to 7% of the principal outstanding, and default-based interest rates are at 24%. These all add up to the total Annual Percentage Rate (APR).

Conclusion

Families consider taking up a personal loan for several reasons. These can range from home improvement to major purchases, medical emergencies to family holiday planning. While making this crucial decision, it is important that you know all the charges that will be levied on your principal amount. That’s why you must know what an annual percentage rate is, the annual percentage rate definition, and its calculations. This will help you fix a budget and follow it for the upcoming months.

If you are interested in taking up a loan from a lending body that makes home loans affordable, you should consider SMFG Grihashakti Home Loan. You can also save yourself the trouble of calculating the EMI for your loan by using our online Home Loan EMI calculator. Check your loan eligibility through our online home loan eligibility calculator and apply for the loan today!

Disclaimer: *Please note that this article is for your knowledge only. Loans are disbursed at the sole discretion of SMFG Grihashakti. Final approval, loan terms, disbursal process, foreclosure charges and foreclosure process will be subject to SMFG Grihashakti’s policy at the time of loan application. If you wish to know more about our products and services, please contact us.